[ad_1]

porcorex/iStock through Getty Photographs

Large-produce investing has admittedly come to be fairly easy in new months, with even some blue-chip names this sort of as Altria (MO) throwing off a near 9% yield. It truly is effortless to develop into jaded, on the other hand, as just one may possibly accept that this is the new norm, particularly looking at the existing inflationary setting.

If history is of any indicator, even so, it can be that large dividends may well not last endlessly, and that now may be a superior time to buy much more of one’s beloved shares whilst also diversifying into other money resources.

This brings me to Horizon Technology Finance (NASDAQ:HRZN), which now yields 10.4%, following obtaining fallen from the $16 stage just previously this 12 months to just $11.55 at current. In this short article, I emphasize what tends to make HRZN a most likely great profits portfolio diversifier, so let’s get began.

Why HRZN?

Horizon Engineering Finance is an externally-managed BDC that gives secured loans to enterprise capital and private equity backed progress firms in the engineering, life science, and health care facts and solutions industries.

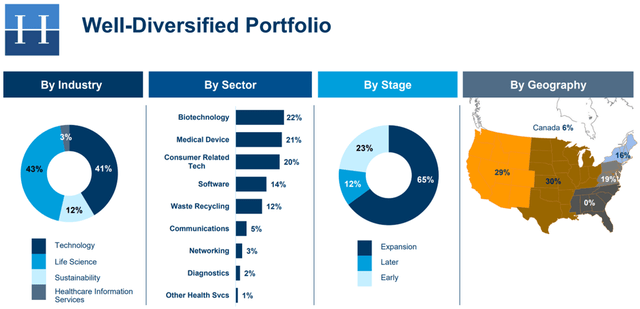

HRZN’s portfolio is perfectly-balanced by sector, with 41% of portfolio fair benefit allotted to technological innovation, 43% to existence science, 12% to sustainability, and the remaining 3% to health care facts systems. As demonstrated underneath, most of HRZN’s portfolio is allotted to companies in the a lot less dangerous expansion and afterwards stages, signaling maturity and additional line of sight.

HRZN Portfolio Combine (Trader Presentation)

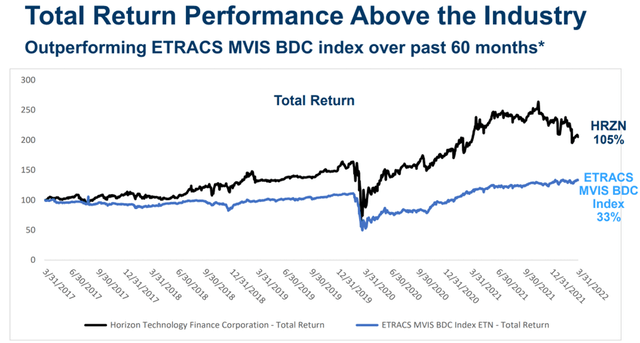

This technique has served HRZN effectively, as shown by its powerful full returns about the earlier 5 several years, with a 105% whole return from 3/31/2017 to 3/31/2022, beating the 33% whole return of the ETRACS BDC Index, as shown beneath.

HRZN Complete Return (Trader Presentation)

Meanwhile, HRZN is looking at reliable fundamental fundamentals, with a large 14.9% ordinary credit card debt portfolio produce in excess of the trailing 12 months, even though this has cooled a little bit to a however sturdy 12.4% for the duration of the initial quarter. HRZN is also looking at extraordinary portfolio expansion of 36% about the earlier calendar year, to $515 million.

Furthermore, HRZN maintains a small chance profile, thinking of that its borrowers have on common a lower 20% mortgage to value ratio, evaluating favorably to the 80% LTV normal for mid-market place financial loans.

This very low-hazard solution is reflected by the truth that HRZN has just 1 investment, MacuLogix, on non-accrual, with management expecting for it to solve itself around the existing and following quarter whilst injecting a little amount of liquidity to make it take place. Plus, administration estimates that practically 96% of the portfolio carries a protected 3-score or greater.

Notably, HRZN is now less than-earning its $.30 quarterly dividend charge (compensated every month) with $.26 NII for each share in the course of the 1st quarter, getting to do with seasonably mild prepayments. On the other hand, HRZN has plenty of cushioning to protect its dividend price, with $.47 for each share of undistributed spillover profits from prior portfolio liquidity situations.

It also has a substantial addressable market and lots of firepower to fund its pipeline, with a reduced .9x personal debt to equity ratio, sitting down very well beneath the 2.0x statutory restrict. This was mirrored by administration in the course of the recent convention connect with:

Our advisor proceeds to enhance the Horizon system with added hires and promoting associates of its staff into vital administration positions, making sure we continue being on course to generate long term advancement and ongoing profitability.

The added benefits of the Horizon system incorporate: an expanded lending platform and the electrical power of the Horizon manufacturer to obtain a larger selection of financial commitment chances, a pipeline of investments that has never ever been larger, enhanced potential to execute on a backlog of commitments and new opportunities and an skilled that is cycle-analyzed and entirely geared up to deal with by way of potential macro or economic headwinds.

Close to-phrase hazards to HRZN contain the downturn in expansion, particularly tech, shares given that the get started of the year, and this may perhaps have a unfavorable influence on HRZN’s portfolio price. Even so, this may well be short-term, and delayed liquidity activities such as an IPO or buyout may result in heightened need for HRZN’s loans, as portfolio corporations may well want to stay away from dilutive equity sales to enterprise capital and personal equity firms.

Last of all, the current share price weakness has designed HRZN much more attractive. It presently carries a rate to e-book value of .99x, sitting down very well underneath its assortment in excess of the earlier 3 decades, outdoors the early pandemic period of time. Provide side analysts have an common price tag concentrate on of $14.13, implying a prospective just one-calendar year 33% total return

which include dividends.

HRZN Rate to Guide (Looking for Alpha)

Trader Takeaway

Horizon Know-how Finance is a small but escalating BDC that has found amazing whole returns more than the earlier 5 many years, prior to the recent downturn. It is benefiting from potent underlying fundamentals, with reliable portfolio progress and produce. With the new share rate weak spot, HRZN seems to be an appealing buy for significant income traders in search of every month dividends and cash appreciation likely.

[ad_2]

Source url